Sports leaders recognise importance of environmental and social impact, but have to be creative when seeking new revenue opportunities

“Ready for it?” is the question posed by David Dellea, the head of PwC’s Sports Business Advisory, in the opening remarks of its 2021 Sports Survey.

Dellea is, of course, referring to the post-Covid landscape that sport finds itself in; a “challenging but exciting time” in which leagues, clubs and federations continue to make sense of what and who will help their organisations become more robust and ready for future challenges.

Despite enduring a difficult 18 months, the overall mood is good. Of the 800 sports leaders canvassed for the survey, 67.2% would describe themselves as optimistic and hopeful. On average, the same group believes that the industry will grow by 4.9% over the next 3-5 years, representing a satisfactory rebuild if realised.

The good news is that the pandemic has appeared to jolt much of the sports industry into life with regards to its environmental footprint and ability to play a role in societal terms. This is indicated by the fact that sustainability – in its purest sense (environmental, social and economic) – forms a significant part of this year’s survey.

As expected, this is largely being driven by external forces, i.e. consumer attitudes and behaviours and the shift by brands to accommodate them. The top two motivations for sports organisations to “actively engage” in social and environmental sustainability are, unsurprisingly, to “build trust of fans and participants” (84.5%) and to meet sponsors’ and investors’ expectations (83.1%), compared with their desire to preserve the environment (the fifth priority with 70.1%).

Regardless of the motivation, the fact that sustainability is increasingly elbowing its way into the vernacular of sports executives is an overwhelmingly positive thing.

Among those questioned, 55.3% – the majority – claimed that sustainability is already part of their “corporate strategy”, with “concrete initiatives” being implemented, compared with 7.1% who either abstained from the question or expressed sustainability’s limited importance to their organisation.

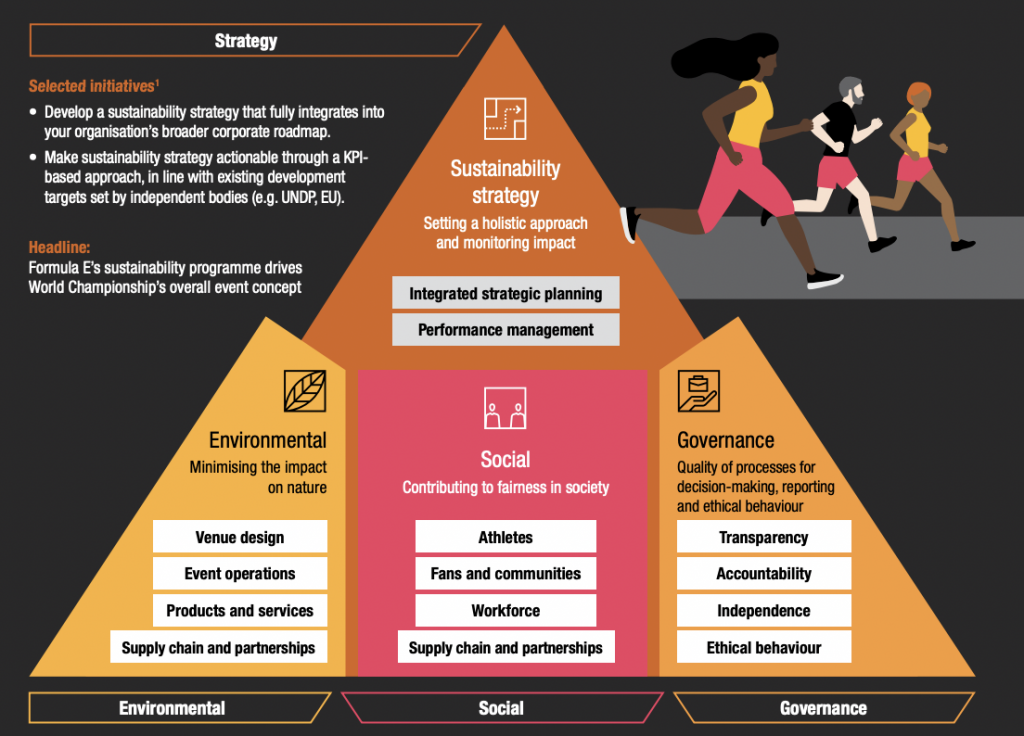

It would be interesting to see how each respondent defined ‘corporate strategy’ and ‘concrete initiatives’, but to reinforce the importance of a holistic approach to sustainability, PwC incorporated an ESG (environmental, social, governance) framework for sports organisation (see below) in its survey, encouraging sports leaders to develop a sustainability strategy that “fully integrates” into the organisational roadmap, as well as KPIs in line with independent targets, such as the Paris Climate Agreement.

And although the majority of sports leaders (56.1%) believe that organisations should primarily focus on increasing revenue when it comes to financial sustainability, a significant proportion (43.9%) reckon the emphasis should be on cutting cost which, in environmental terms, alludes to reduction in energy use and consumption of materials and products.

But – and this is a big “but” – when it comes to the future prospects of sport’s ability to generate that extra revenue, two areas of growth mooted by the report, betting and non-fungible tokens (NFTs), appear to be at odds with sport’s need to drive social and environmental good.

While it’s clear that the industry must disrupt its own business model, and shift away from some of its more traditional revenue streams to stay competitive and relevant, it appears to be at a crossroads – in one direction is a drive down the quick revenue superhighway; a journey potentially fraught with accusations of greenwashing. Or, there’s the creative route, with responsible but, currently, less clear revenue opportunities.

This challenging and exciting period, after all, is the sports industry’s best opportunity to venture down the latter route. Sports leaders claiming to have sustainability as part of their corporate strategy, but opting for the former route, may need to rethink their approach or risk losing the trust of the external stakeholders they desire deeper relationships with.

Dellea, who spoke with The Sustainability Report shortly after the publication of the 2021 Sports Survey, acknowledged the “tension” between the ambition and need to be socially and environmentally responsible, and the revenue growth opportunities currently on offer for sport.

While NFTs (unique digital items, typically sold by sports organisations in the shape of collectibles and voting opportunities) are responsible for significant energy use and, therefore, greenhouse gas emissions, Dellea adds that the “ballooning amount of data” sport is using, through OTT and gaming platforms, for example, poses a problem more generally.

However, his colleague Robin Fasel, a senior consultant at PwC’s Sports Business Advisory, believes that progress is being made, with more sports organisations becoming aware of the potential environmental and social pitfalls related to some revenue-generating opportunities, with leaders incorporating sustainability into their commercial strategy, as well as their event concepts and venue plans.

“Think about how sports organisations were tackling sustainability in the past; it was mostly ad-hoc CSR processes,” he says. “If they’re starting to think about sustainability when strategising NFT opportunities, for example, that’s progress for the industry I would say. We’re moving in the right direction.”

Forward-thinking sports organisations are identifying ways to disrupt the status quo by incorporating sustainable business models through diversification or investment. Earlier this year, The Sustainability Report explored sport’s move into the world of impact investing (which focuses on social and environmental good, as well as economic return), particularly honing in on The Equity League concept devised by the Green Bay Packers, Milwaukee Bucks and Milwaukee Brewers.

In terms of diversification, a handful of Major League Baseball teams have incorporated a subscription ticketing offer, similar to the model of Netflix and Spotify, to give spectators more flexibility than a season ticket. This has seen the number of young people and individuals from less privileged backgrounds attending games increase. The approach will be tested by Premiership Rugby club London Irish this season.

And we’re seeing innovation in the sponsorship arena; in the last year, the Seattle Kraken NHL team (Climate Pledge), a number of Denver-based sports franchises (Ball) and a group consisting of the Phoenix Suns, Phoenix Mercury and Real Mallorca of La Liga (Footprint) have agreed venue naming rights deals with environmental sustainability activations at their core.

And while Dellea sees this shift away from reactive sustainability measures towards a more integrated approach to ESG strategy that a widely adopted outside of sport, he stresses that federations, who have a “monopolistic” status in their sport – those “entrusted as the only organisations able to crown World Champions” – have a greater obligation, from a governance perspective, to focus on ESG improvements and adopt revenue models to make them sustainable in all three aspects.

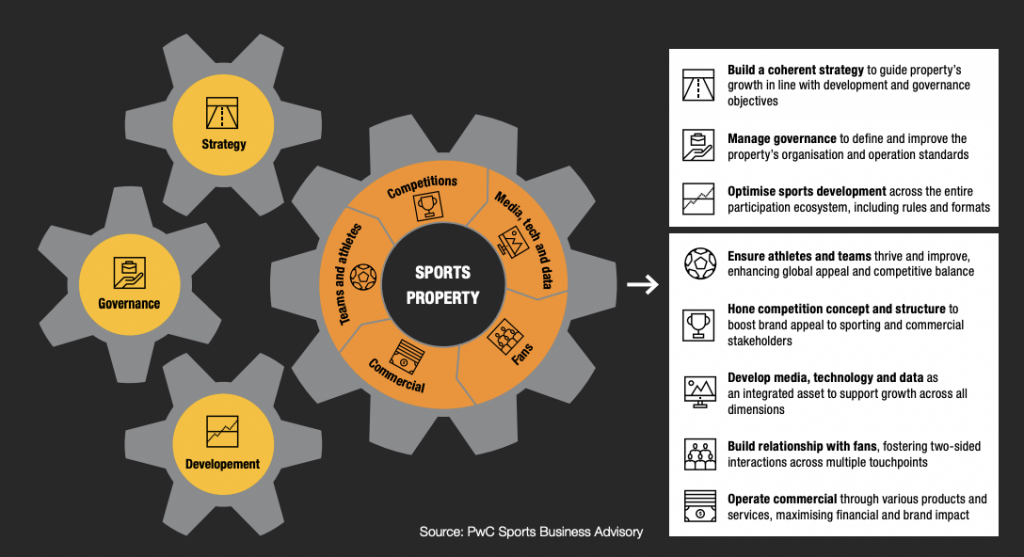

Governance, strategy and development are three of the cogs that keep sports organisations moving forward smoothly, as per PwC’s Sport Property Development Framework (see below), and Dellea insists that ESG is an “underlying element” of all three rather than a standalone dimension.

“When it comes to governance – taking decisions, stakeholder engagement, strategic development – ESG criteria are key,” he explains. “If sport wants to incorporate ESG more broadly, then governance is where everyone should start because governance has been a challenge in sport for quite a while.”

Indeed, the survey demonstrated the governance reforms that are the highest priority to rights holders going forward. They include:

– Build up entrepreneurship and commercial agility

– Transform operations/ways of working

– Apply cost control measures

– Implement enhanced transparency standards

– Modernise sport’s rules and experience

– Redesign sport’s calendar and competition

While a strategic approach to sustainability and ESG is not a silver bullet to address all of the above, it can significantly contribute. Reducing costs (through energy efficiency) and enhanced transparency are obvious areas, but sustainability also filters into commercial agility (through revenue model diversification, as described above), the redesign of sport’s calendar (with a reduction of carbon emissions as a key motivator), and transforming ways of working (to a more circular approach).

And, crucially, Dellea believes that in the next 10 years, companies investing in and acquiring sports organisations will begin to appraise ESG criteria in the same way they are appraised in other industries – although we’re not there yet.

“I would hope that investors in sport would look at ESG criteria in the same way as other businesses, but currently I’m not sure,” he acknowledges. “It depends on how the investors are set up.

“From what we observe, investors are beginning to ask questions about how sport is tackling social and environmental issues, but I would not expect this to be a potential deal-breaker today. But I hope that in the next decade that will be the case.’”

Opt into our weekly newsletter for exclusive content focused on sustainability strategy, communication and leadership for sport’s ecosystem.

Leave a Comment

Your email address will not be published. Required fields are marked with *